- The Fed is a cartel in partnership with the federal government. Fractional reserve banking allows banks to keep only a fraction of their deposits while lending out the rest with interest to other clients. Banks are therefore capable of loaning out money which they do not, in fact, possess (http://www.economicreason.com/). Banks create money by making loans based on this fraud (fractional reserve banking). It allows banks to make loans not backed by savings at artificially low-interest rates. It is inherently inflationary.

- You cannot taper a Ponzi scheme. Between Powell’s unwavering stance on the “autopilot” process of quantitative tightening (Dec 2018) and ‘act as appropriate to sustain the expansion’ (Jun 4, 2019), there was a period of just half a year! Basically, there will be more QEs than Rocky Movies (Peter Schiff), no matter how they name it.

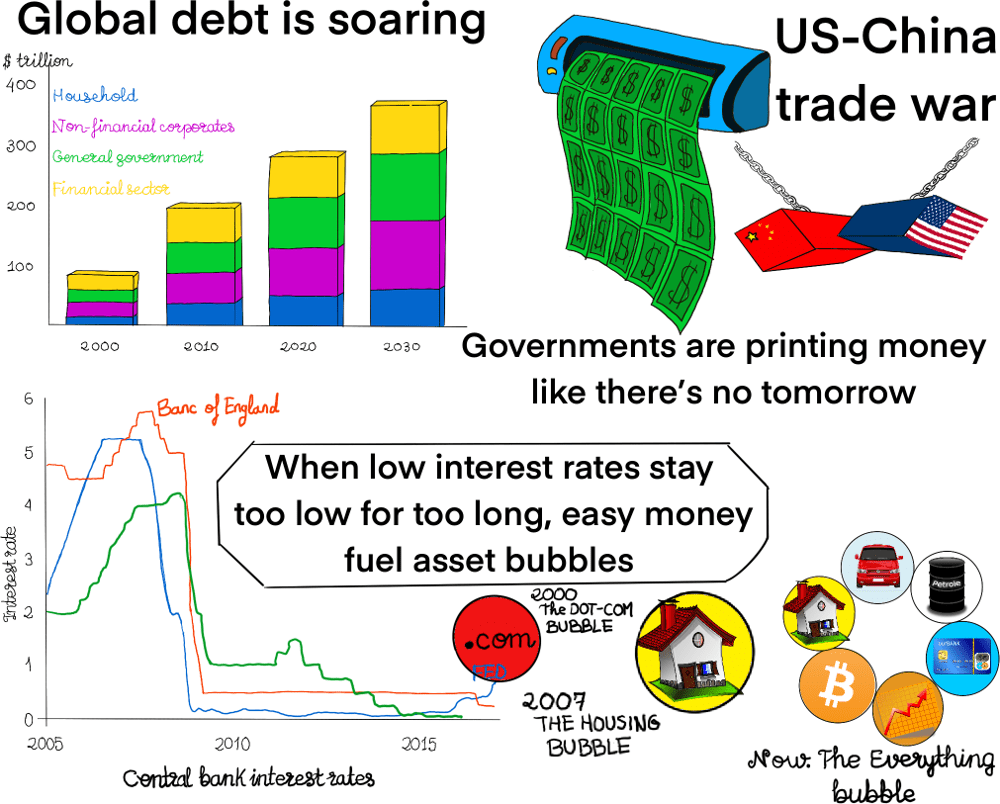

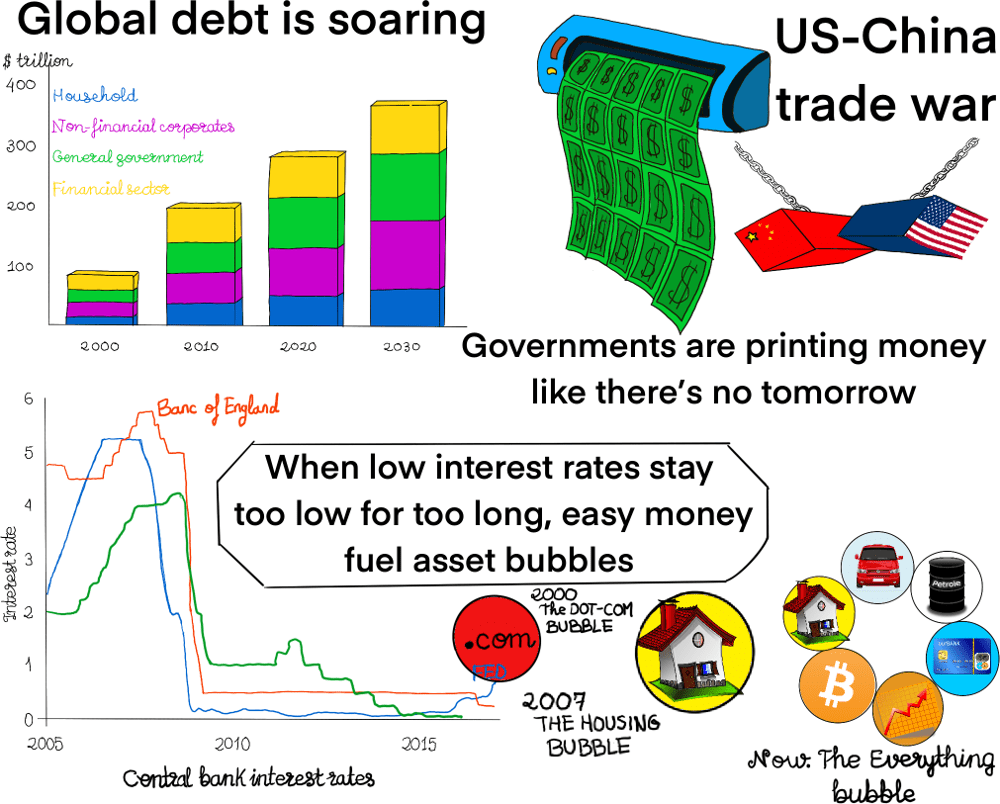

- You can’t print your way to prosperity. Printing money causes inflation and devalues your currency. It is a form of taxation through inflation.

- Fiat currency always eventually returns to its intrinsic value — zero!

- We are in a big fat ugly #bubble and trust me, all bubbles pop no matter what they say.

- Pensions are ‘decimated’ by low-interest rates. Real assets are a good late-cycle investment. There is no top in gold prices, because there is no botton in fiat money.

- There is now more than 15 trillion dollars of debt with a negative yield. “Now, governments are essentially getting paid to borrow money, as people become increasingly desperate for a safe haven for their wealth,” cnbc.com.

- Debt is a ticking bomb. “[Global] Debt rose by $3 trillion in the period (in the first quarter of 2019) to $246.5 trillion, almost 320% of global economic output” (https://www.bloomberg.com).

- The stats are phony. For instance, “chronically unemployed are removed from statistics (job unemployment) and 4 jobs for 4 people could mean that only one is working those 4 jobs!” (David Hayes)

- Maybe I am wrong… “A 100-Year Austrian Bond at 1.2%. What Fresh Madness Is This?” (Bloomberg.com) and “Danish bank launches world’s first negative interest rate mortgage. Jyske Bank will effectively pay borrowers 0.5% a year to take out a loan” (https://www.theguardian.com).

- Disruptive technologies: 3D printing, Artificial Intelligence, Virtual and augmented Reality, Self-driving cars, Robots, Internet of Things, etc. “AI will make jobs kind of pointless,” Elon Musk.

- “Global inequality, as measured by the ratio T10/B50 between the average income of the top 10% and the average income of the bottom 50%, more than doubled between 1820 and 1910, from less than 20 to about 40, and stabilized around 40 between 1910 and 2020,” World Inequality Database.

- Social Unrest: “Over 230 significant antigovernment protests have erupted worldwide. More than 110 countries have experienced significant protests,” Global Protest Tracker.

The Great Depression of 1929 in the United States is used as an example of how quickly an economy can decline. Many regard economic collapse as inevitable due to overpopulation, a demographic crisis with an increasingly aging population that requires social support services, resource shortages, excessive unemployment rate, unsustainable debt levels (the global credit bubble), inadequate economic policies, and peak oil.

Do not trust those who talk about business cycles, who argue that bailout money given to large financial corporations is for revitalizing the economy (they receive our cash, we and our children will pay for their excesses through state deficits and severe adjustment policies); that sustainable economic growth can be based on consumption beyond our means and on credit; that creating or printing more money from thin air will solve economic problems as if by magic, etc.

Why the economic collapse is almost unavoidable?

When private industry makes a mistake, it gets corrected and goes away. As governments make mistakes, it gets bigger, bigger and bigger and they make more, more and more because as they run out of money, they just ask for more and so they get rewarded for making mistakes. In the meantime that is exactly what we are doing by subsidizing companies which are failing, we have a reverse Darwinism, we’ve got survival of the unfittest, the companies and people that have made terrible mistakes are being rewarded and other people are being punished and being taxed, Peter Schiff.

The Economic Collapse is a ticking Time Bomb, a mathematical certainty. Let me explain why:

-

Global debt “has hit another high, climbing to $247 trillion in the first quarter of 2018. […] The debt-to-gross domestic product (GDP) ratio has exceeded 318 percent […] The unprecedented debt load is one of several investor concerns, in addition to worries about the Federal Reserve’s monetary policy tightening and the impacts of a trade war,” Source: CNBC.

“With big banks falling over like drunks on a Saturday night the papers are full of explanations. The final stage is reached when speculators swoop on the weakest organisations and make a fortune by finishing them off through “short selling” […] It’s a drastic state of affairs when taxpayers have to step in to save the banks. Profits are being privatised and losses are being nationalised,” Is this the collapse of capitalism?, Derry Journal.

Continue Economic Collapse second part

Continue Economic Collapse second part